A step-by-step guide to starting a business in Vietnam

- 3:22 am

- admin

If you are a foreigner wanting to start a business in Vietnam, you may be wondering how to do it.

Vietnam is one of the fast-growing economies, with a stable political system, young and highly qualified human resources, and relatively cheap labor costs. The cost of living is relatively cheap.

However, carrying out legal procedures, especially corporate procedures and tax policies that frequently change, can be difficult, especially if you are not familiar with the local language and culture. direction.

In this post, GTax will provide you with a step-by-step guide on how to start a business in Vietnam as a foreigner, including:

- Restrictions and conditions for foreign investors;

- Popular types of businesses in Vietnam and how to choose the type that best suits your needs;

- Necessary documents and costs to establish a company;

- Tax issues and duties when doing business in Vietnam;

- Should you rent an office or use shared office services?

Company set up process

First: Check restrictions and conditions for foreign investors

Before starting a business in Vietnam, you must check whether your intended business activity is permitted or restricted for foreign investors. According to the Investment Law, there are a number of business activities that foreigners are not allowed to conduct in Vietnam, such as:

- Prostitution, human trafficking or copying of business activities involving humans;

- Business related to fireworks;

- Debt collection;

- Narcotics, toxic chemicals, precursors and minerals;

- Natural specimens of endangered, precious and rare wild animals and plants;

Some business activities are conditional for foreign investors, meaning you must meet specific criteria to access the Vietnamese market. Include (You can find a full list of restricted and conditional business activities in the Law on Investment):

- Accounting and auditing services;

- Tax agency service;

- Customs-related business;

- Securities-related business;

- Insurance/ Reinsurance/ Insurance brokerage/ Insurance agency/ Insurance auxiliary services;

- Price valuation service;

- Other financial businesses, such as lotteries, debt collection services, credit rating services, prize-winning electronic games for foreigners, casino business.

Step 2: Choose the type of business in Vietnam

Choosing the best form of business entity depends on your goals, budget, risk appetite, and industry.

There are two main ways for foreigners to invest in Vietnam: directly and indirectly.

Direct investment: means you establish a new company in Vietnam, either as a 100% foreign-owned company or a joint venture with a Vietnamese partner. To do this, you must obtain a business and investment license from the authorities.

Indirect investment: means you buy shares of an existing company in Vietnam. This way, you can get a position in the company’s management board, depending on the agreement between you and the Vietnamese company.

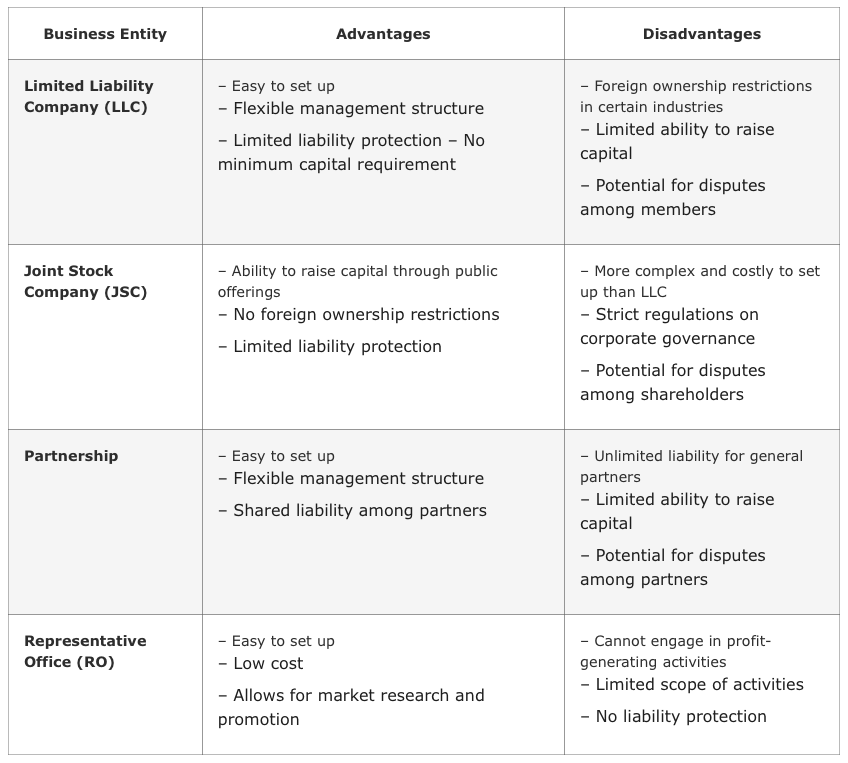

The most common forms of business organization for foreigners in Vietnam are:

1. Limited liability company (LLC):

A company with one or more members who are only responsible for debts within the scope of their capital contributions. An LLC can be a single-member LLC or a multi-member LLC. LLC is suitable for small and medium-sized businesses that want flexibility and autonomy in management.

2. Joint stock company (JSC):

This company has at least three shareholders who are only responsible for debts within the value of their shares. Joint stock companies can issue stocks and bonds to mobilize capital from the public. Joint stock companies are suitable for large-scale businesses that want to access more capital and expand their presence in the market.

3. Representative office (RO):

This is not a legal entity but an office representing the interests of foreign companies in Vietnam. RO can carry out non-commercial activities such as market research, promotion, communication, etc., but cannot carry out direct business transactions or generate income in Vietnam. RO is suitable for businesses that want to explore market potential and establish relationships before officially establishing a company.

4. Partnership:

This firm has at least two partners who share profits and losses according to their agreement. A partnership can be a general partnership or a limited partnership. A general partnership has unlimited liability to all partners. In contrast, a limited partnership has at least one general partner with full liability and one or more limited partners with limited liability. Partnerships are suitable for businesses that want to leverage the skills and expertise of different partners.

Each type of business above will have advantages and disadvantages. If you are still confused about this content, please contact GTax consultants to make the most suitable decision. Below is a summary comparison table for your easy reference.

Step 3: Prepare the required documents and costs

Once you have decided on the form of business entity, you need to prepare the required documents and costs for setting up a company in Vietnam.

Depending on the type of business entity, you must prepare specific documents to complete the process of setting up your business in the country. Such as:

- ID card/Passport of capital contributing members;

- Company name and form of company expecting to be established;

- Lease agreement and head office address of company expecting to be established;

- Business line for the company expecting to be established;

- The legal representative of the company expecting to be established;

- Contribution capital to the company, the type of contribution capital;

- Capital contribution members, capital contribution ratio of members;

- Proof of financial capacity;

- Investor documents;

(*) Any foreign documents will need to be notarized, legalized by consular officials, and translated into Vietnamese by competent authorities.

The costs for setting up a company in Vietnam vary depending on the type of business entity, the capital size, the business activity, and the service provider. Generally, the costs include:

- Market research costs: This is optional but recommended if you want to have a better understanding of the market demand, competition, opportunities, and challenges for your business in Vietnam. The cost of market research depends on the study’s scope, depth, and duration.

- Legal written report: This is optional but recommended if you want to have a clear and comprehensive overview of the legal aspects of starting a business in Vietnam, such as the restrictions, conditions, procedures, and costs. The cost of a legal written report depends on the complexity and length of the information.

- Investment certificate and enterprise certificate costs: These are mandatory for direct investment and vary depending on the type of business entity, the capital size, and the service provider. The average cost ranges from USD 1,250 to 2,500 for foreign-owned enterprises and USD 350 to 1,000 for Vietnamese-owned enterprises.

- Sublicense costs: These are mandatory for some conditional business activities that require additional licenses or permits from the relevant authorities, such as accounting, auditing, tax, customs, securities, insurance, etc. The cost of a sublicense depends on the type and number of licenses or permits required.

- Charter capital: This is mandatory for direct investment and refers to the amount of money the members or shareholders contribute to the company. The minimum charter capital depends on the type of business entity and the business activity. For example, an LLC requires at least VND 10 million (USD 430) as charter capital, while a JSC requires at least VND 30 million (USD 1,300). However, some business activities, such as real estate, banking, education, etc., may require higher charter capital.

- Post-certification procedures: These are mandatory for all business entities and include tasks such as opening a bank account, registering for tax code, printing invoices, applying for social insurance, etc. The cost of post-certification procedures depends on the type and number of tasks required.

Step 4: Resolve tax issues and obligations

After establishing a company, you need to resolve tax and duty issues when doing business in Vietnam.

You must register for a tax code, declare taxes, pay taxes and keep accounting records according to Vietnamese tax laws.

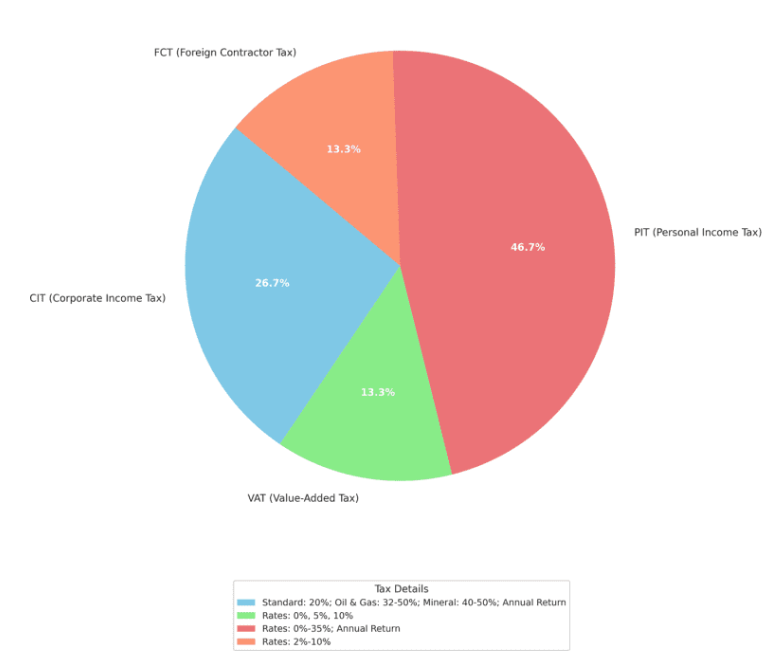

The main types of taxes that you need to pay:

- Corporate income tax (CIT): This is a tax on the profits earned by your company in Vietnam. The standard CIT rate is 20%, but some preferential rates may apply depending on your industry, location, and investment incentives. You need to file CIT returns quarterly and annually and pay CIT accordingly.

- Value-added tax (VAT): This is a tax on the added value of goods and services sold or consumed in Vietnam. The standard VAT rate is 10%, but some reduced rates (5%) or exempted rates (0%) may apply depending on your goods or services. You need to file VAT returns monthly or quarterly and pay VAT accordingly.

- Personal income tax (PIT): This is a tax on the income earned by individuals in Vietnam. The PIT rates range from 5% to 35%, depending on your income level and resident status. You need to file PIT returns annually and pay PIT accordingly.

- Foreign contractor tax (FCT): This is a tax on payments made by Vietnamese entities to foreign contractors for goods or services provided in Vietnam. The FCT rates vary depending on your goods or services and consist of CIT and VAT components. You need to file FCT returns monthly or quarterly and pay FCT accordingly.

- Other taxes: These include taxes such as special consumption tax, natural resources tax, environmental protection tax, import-export tax, property tax, etc., depending on your goods or services.

Are you still confused and can’t know exactly what taxes need to be paid when doing business in Vietnam? GTax accounting services will assist you with this issue because we are experts in the field of tax and accounting in Vietnam.

Primary tax type for Business in Vietnam

Step 5: Choose a business address

A business requires a legal address in Vietnam in order to incorporate a company in the country. Most businesses require that it have its own physical location, such as an office or building leased or acquired. In addition, you can also use virtual office services, shared offices,…

- Virtual office address: best if you do not need a physical place to work in Vietnam;

- Working desk (or coworking space): best for 1-3 employees;

- Fully serviced office: best for established companies with a team of employees;

- House/building/commercial property: suitable for businesses that provide onsite services to customers such as: retail shops, restaurants, and healthcare facilities;

- Industrial property, such as land in an industrial park or ready-built factory, require for manufacturing businesses.

- Economic zones and high-tech zones

- Locations with especially difficult socio-economic conditions.

GTax recommends that you choose a coworking space to optimize your costs and network.

Choosing a coworking space can be a smart way to optimize costs when starting a business in Vietnam. Coworking spaces offer flexible and affordable options for entrepreneurs who need a professional and comfortable working environment without the need to rent an office. Coworking spaces also provide opportunities to connect, collaborate and learn from like-minded people.

Currently, you can refer to GTax’s partners in the field of providing shared offices: G-Office, Dreamplex, Serepok, Toong, Regus, Vietoffice… GTax will support you in checking if a specific location is eligible to enjoy tax incentives.

Things you should prepare before starting a business

- Vision and ideas

Viable business ideas don’t have to be revolutionary – they often come from changing just one component of existing ideas. Go for numbers, not quality.

Your vision should define your product or service, target audience, and industry.

- Study

Research and testing is the best way to know if a business idea is good or not. There are several ways to solve this problem.

First, get a big picture of the industry, competition, and target audience.

a. Market research reports

b. Trade magazine, news site or trade show

While doing this, you should focus on current issues, restrictions or new regulations, especially related to sustainability and safety. These are gaps that you can fill.

Second, gather opinions about your business idea. You can try:

a. Social media survey.

b. Join online forums and communities and present your business idea to your target audience. Ask for their feedback. You can also organize focus groups and one-on-one interviews.

Third, test run the idea based on your research. Assemble a limited number of designs, sizes and versions or build prototypes. Then, create a website or online platform showcasing your products, search engine optimization to gauge market demand for your pilot products, and start learning about your target customers. your.

- Business plan

Your first foray into testing your idea will give you valuable insights into how viable your idea is. Use those insights in building a business plan to turn your idea into a full-fledged startup.

You may need to go back to the drawing board to refine your ideas to scale, adjust operating costs, and seek financing.

This phase is not linear. It’s normal to go back and forth to develop and refine your ideas, sometimes even targeting an adjacent idea or target demographic.

- Financial Essentials

Networking is essential in drawing in funding for your business. Joining local startup communities, attending events, and participating in seminars can open doors to potential investors and partners.

When seeking funding, always ensure that:

- Your business plan is solid and well-researched.

- You understand the terms of any funding agreement, especially if equity is involved.

- Legal agreements are in place, regardless of the funding source.

Here are some good places to start looking for investment.

1. Bootstrap

Not just your own savings but also the contributions from your immediate family and close friends. It’s the most straightforward way to start. To lower the risk, it is crucial to document any loans or investments from friends and family properly to prevent future conflicts.

2. Angel investors

Individuals who provide startup capital in exchange for ownership equity or convertible debt. Vietnam has a growing community of angel investors, especially in the tech sector. For example, check out Vietnam Angel Network or this list of top angel investors in Vietnam.

3. Venture Capital

As Vietnam’s startup scene has grown, so has the interest from venture capitalists (VCs). Local VC firms lead the way in actively investing in Vietnamese startups. Notable VCs include 500 Startups Vietnam, IDG Ventures, and CyberAgent Ventures. Your chosen industry can be a determining factor. For example, SK – a South Korean fund with $2 billion in investment in Vietnam favors consumer and healthcare projects. STIC Investment, which has invested $300 million in Vietnam, is interested in logistics, e-commerce, and healthcare.

4. Incubators and Accelerators

These are organizations designed to help startups succeed. They usually offer office space, mentoring, and sometimes funding in exchange for equity in the company. Examples include the Vietnam-Finland Innovation Partnership Program (IPP) and the Topica Founder Institute.

5. Government Grants and Competitions

The Vietnamese government, recognizing the potential of startups, occasionally offers grants, competitions, and incentives to promote innovation. For instance, the National Technology Innovation Fund (NATIF) supports tech startups.

6. Strategic Partnerships

Partnering with established companies in a related field can provide essential funding and expertise. Such partnerships can also give your startup credibility and access to the partner’s customer base or resources.

- Operational Essentials

No matter the type of your business model, here are the basic essentials to take into account:

- Location: remote work or in-person in a home office or coworking space.

- Equipment and tools, either physical or digital.

Initial inventory and supply chain (if applicable). - Staffing, salaries, and benefits.

- Branding, marketing, and sales.

- Compliance and reporting

When using GTax’s services, Consultants will help you consider the advantages and disadvantages of each option and advise you on the best solution for your needs.

Source: Internet – Compiled by GTax Accounting Service

How to setup a new company in Vietnam

Most foreign investors who want to invest in Vietnam face difficulties in legal procedures to obtain a legal business license. Through this article, GTax will provide you with some basic

What types of taxes in Vietnam will be applied to foreign companies?

Currently, foreign investors doing business in Vietnam will be subject to many taxes. It is important that you understand the different types of taxes in Vietnam that you may

Personal tax rates on other income in Vietnam

Personal income tax is your income through business, salary, wages, inheritance, interest or dividends… Vietnam’s personal income tax rate is calculated based on the type of residence. GTax has

-

How To Make Investment In Vietnam

-

Designing Functional Home Offices

-

Setting up a home office: How much does it cost?

-

How to setup a new company in Vietnam

-

Compare office rental prices in Ho Chi Minh City for foreign businesses starting a business

-

Head office registration requirements for newly established companies in Vietnam

-

The difference between a Representative Office and a Foreign Invested Company

-

A step-by-step guide to starting a business in Vietnam

-

What type of business to choose in Vietnam?

-

Forms of business in Vietnam